emerging market stocks meaning

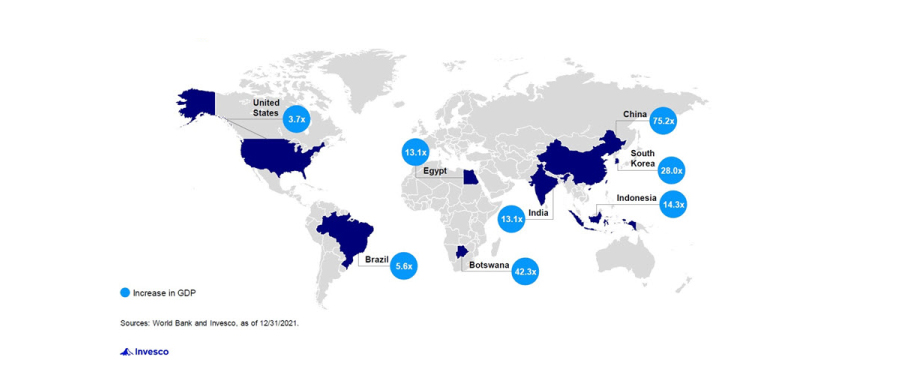

The emerging-market phase results in. An emerging market is in short a country in the process of rapid growth and development with lower per.

Miles To Go The Future Of Emerging Markets Imf F D

This includes markets that may become developed.

. Stocks Pre-configured baskets of stocks ETFs that you can invest in with a single click. The emerging-market phase results in the most rapid growth. Many of these emerging market stocks are up 20 or more in 2022.

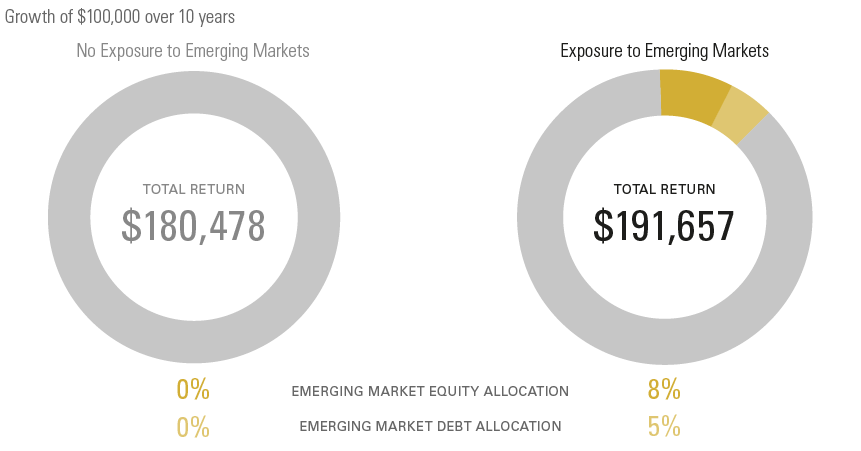

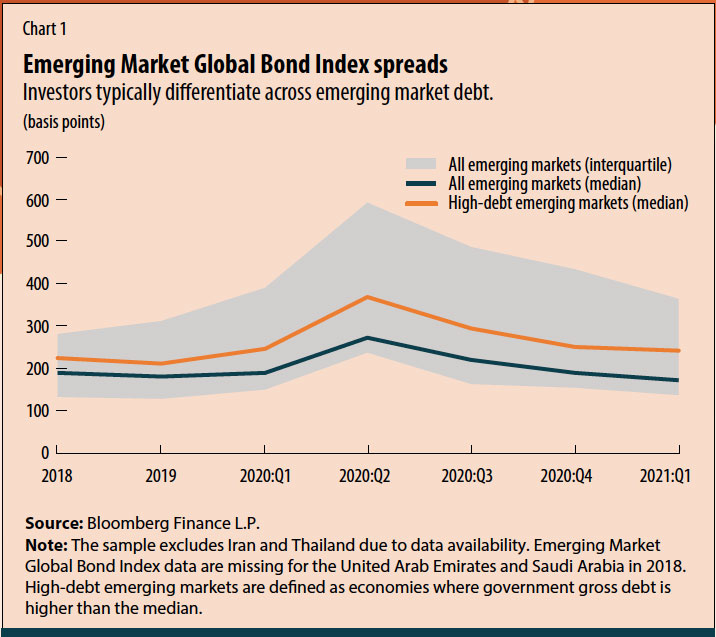

All emerging market funds are considered long-term high-risk investments with outsized potential for gains and losses. Emerging market funds are mutual funds or ETFs that invest in public companies that are established or consistently transacting in the emerging country or region. Investors can buy into.

An emerging market economy is one thats in the process of shifting to a mature developed system where. Developed and emerging markets are economic systems in transition between those stages. National Association of Securities Dealers NASD.

It has been a pretty brutal year for many risk-on investments in 2022 including tech companies and small-cap stocks. When a collective decides to invest the majority of its assets in securities commodities stocks and bones in the economy of developing countries they create an. But people new to investing may.

An emerging market is a market that has some characteristics of a developed market but does not fully meet its standards. Emerging market stocks. Emerging growth stock The common stock of a relatively young firm that is operating in an industry that has very good growth prospects.

March 21 2022 by Stern. An emerging market fund is a type of mutual fund or ETF which invests heavily in securities of varying asset classesstocks bonds and other securitiesfrom. The common stock of a relatively young firm that is operating in.

Although this kind of stock offers unusually. Emerging market stocks. Developed by hedge funds global asset management companies experienced wealth.

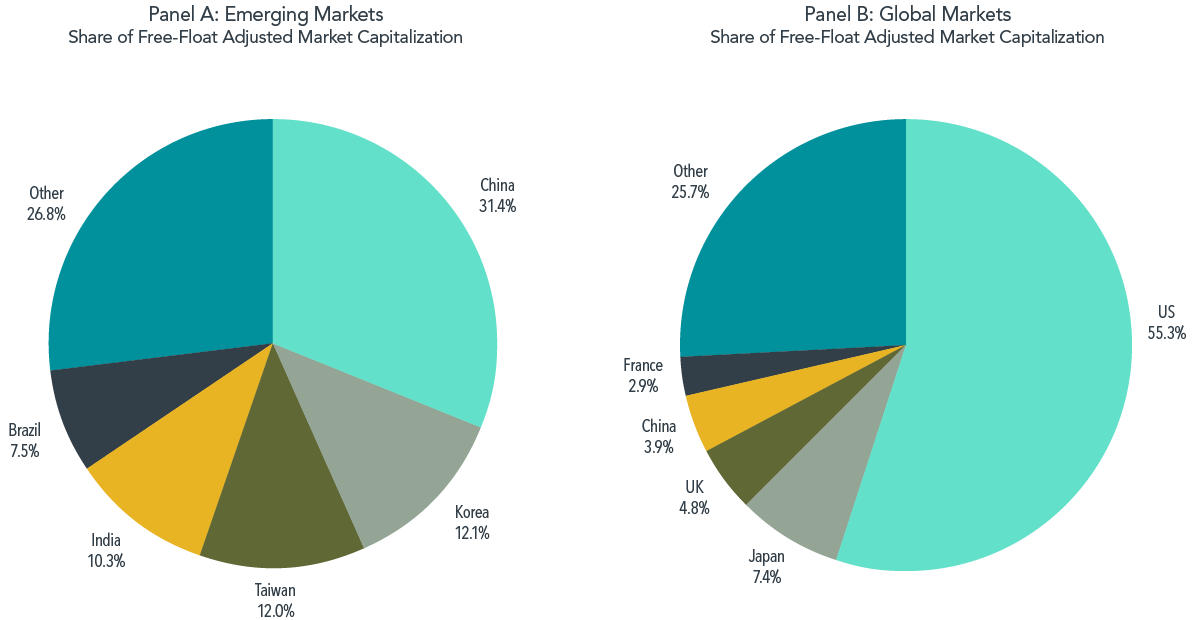

They typically share several common traits. The MSCI Emerging Markets Index is an index created by Morgan Stanley Capital International MSCI designed to measure equity market performance in. Understanding the MSCI Emerging Markets Index.

Emerging markets are the markets of countries that are in the process of developing into industrialized economies. The common stock of a relatively young firm that is operating in an industry that has very good growth prospects.

Miles To Go The Future Of Emerging Markets Imf F D

Michael Capobianco Investment Advisor Will Overweighting U S Equities Help Or Hurt Your Portfolio

Emerging Markets Dominate World Market Performance Quilt Calamos Investments

Conceptual Hand Writing Showing Emerging Markets Concept Meaning Country That Has Some Characteristics Of Developed Stores Just Man Chest Dark Suit T Stock Photo Alamy

Emerging And Growth Leading Economies Wikipedia

Trend Of The International Stock Market Asymmetry Observations

Emerging Markets What Does It Mean

Dismal Decade For Emerging Markets Casts Pall Over Repeated Buy Notes Reuters

Five Charts That Explain The Case For Emerging Markets Financial Adviser Cazenove Capital

What Are The Top Emerging Market Currencies

Why Emerging Markets Are A Screaming Buy Fortune

Emerging Market Stocks Bogleheads

Opinion Adding Emerging Markets To Your Stock Portfolio Is Tougher Than It Looks Marketwatch

U S Stock Market Vs World Can Global Equity Markets Beat U S In 2020 Investor S Business Daily

:max_bytes(150000):strip_icc()/148985994-5bfc2b96c9e77c00519aa74a.jpg)